We have been hearing a lot about inflation recently, what it means for the Economy, the Fed’s responsibility to keep it under control and how it affects the capital markets. Federal Reserve Chairman Jerome Powell spoke to congress this week, answering questions from lawmakers in Congress about steps the Fed is taking to lower inflation and forecasts about expectations going forward. Disinflation was routinely cited and discussed as a positive sign that progress is being made to lower inflation.

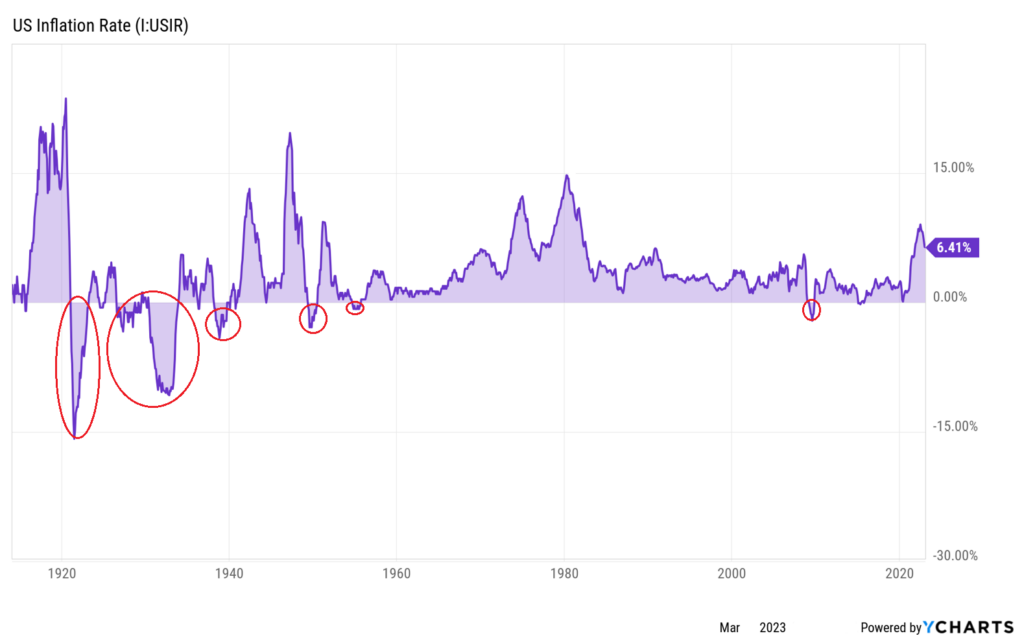

When inflation is too high, individuals and the Economy can suffer, while the opposite, deflation or too little inflation, is also bad (home prices declining for example). Outright deflation, however, where prices decrease year over year, is a rarity. Historically we have seen only 6 periods of deflation since the early 1900s, as illustrated by the red circles in the US Inflation Rate chart below. Three of those six deflationary periods were part of the Great Depression. The past few years have broken a decades long-trend of moderate to low inflation, with the US and other developed economies experiencing price increases not seen since the 1970s and 1980s.

The re-inflation of the past few years was a result of various factors (supply chain issues, aging demographics, technological changes, fiscal & monetary policies) coalescing to form a “perfect storm” for inflation being well above the 2-3% long-term average. Debates will continue on the main causes and the responsibilities borne, but the data show persistent inflation that is not as “transitory” as the Federal Reserve had first predicted.

History shows that re-inflationary cycles are quite persistent and sticky, as experienced during the 1970s. Following periods of re-inflation, when the rate of inflation increases year over year (4%, 5%, 6% for example), there is an expectation for Disinflation, where the rate of inflation decreases year over year ( 6%, 5%, 4%). Disinflation still means that prices increase and things continue to get more expensive every year, but not at the same pace. Some of the factors like supply chain, monetary & fiscal policy issues are starting to ease. The question remains as to how much disinflation we will experience and if it will be enough to lower inflation back down to the Fed’s target of 2%, at which point the Fed’s tightening policies are expected to pause, ushering in opportunities for the capital markets and interest rate sensitive investments to rebound.

~Shar Gogerdchi, CFP®