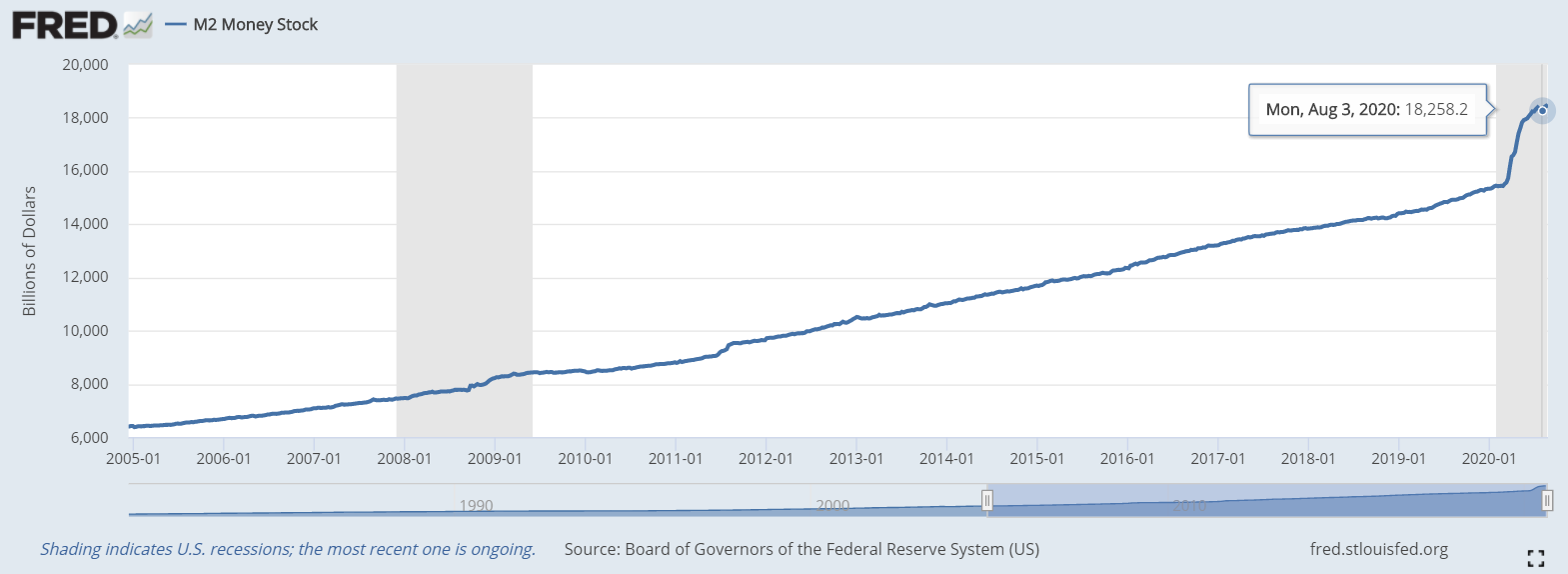

One of the first places we are seeing signs of these effects is in the M2 Money Supply, which is measure of money in circulation including cash, checking deposits, and easily convertible instruments like money market funds. The M2 money supply has been rising at a historic pace in the past few months and that traditionally leads to inflation, an objective that the Fed seeks.

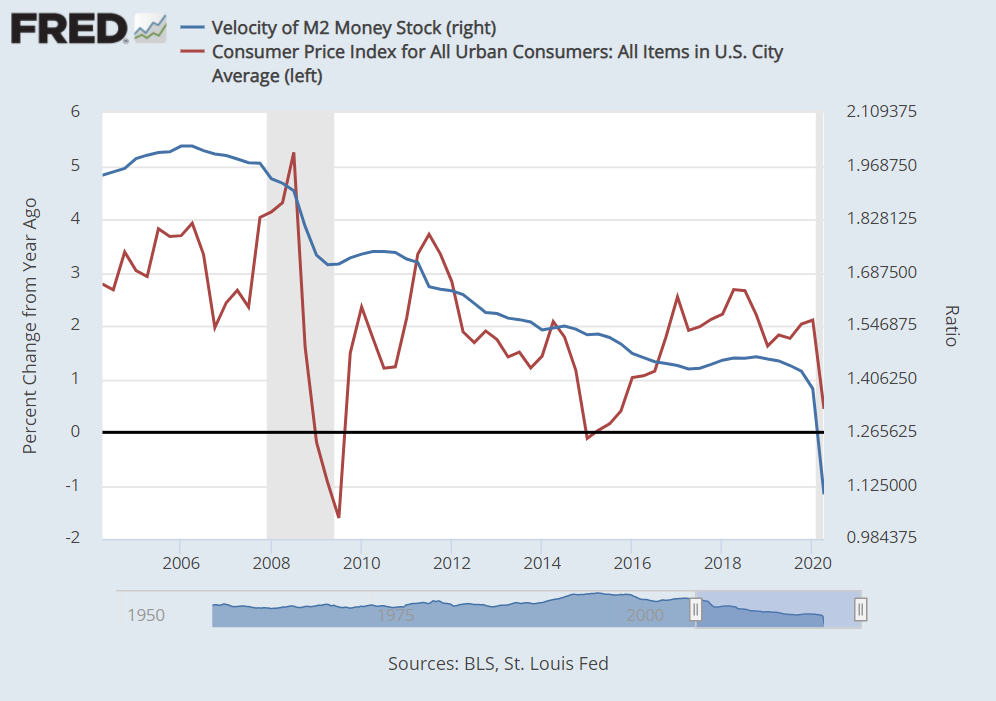

The dramatic monetary response may be warranted given the uncertainties surrounding the economic impacts from COVID-19, but what is also uncertain is how inflation and prices will react to this level of M2 increase. In addition to the supply of money, another factor for inflation is the velocity of money, or the rate at which money is exchanged in the economy (spending vs. saving). As we can see from the data below, the M2 Velocity has been decreasing since right before the 2008 financial crisis, and the decrease accelerated during the pandemic.

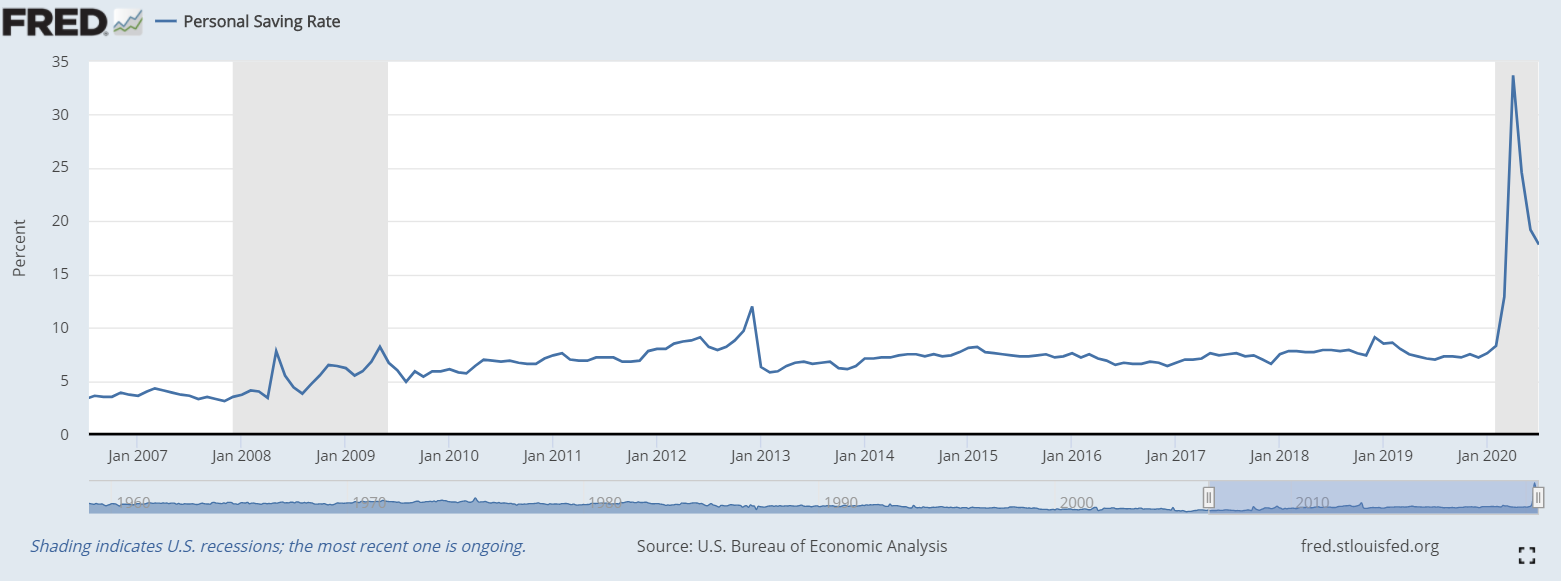

Although the Fed has been “printing money” at a record pace and adding to the Money Supply, the effect on inflation has been muted with Velocity down-trending since 2006. This could be a result of various factors including increases in the Personal Savings Rate, chart below, which has been elevated since the 2008 crisis. As people save more and less money is exchanged in the economy, Velocity can outweigh the Fed’s money supply pressures on inflation. Increased savings may be due to an aging demographic or based on uncertainties surrounding income during recessions.

In the most recent statement on August 27, 2020, the Fed adjusted their original Longer-Run Goals and Monetary Policy Strategy from 2012 to allow for flexibility in temporarily overshooting their 2% inflation target. We will see what additional steps the Fed will take to achieve this goal, beyond what is already in place, but they have made it very clear: they will do whatever it takes.

~Shar Gogerdchi, CFP®