With only a few weeks left in 2022, we will soon ring in the New Year and look back on this challenging year for the markets. Bond investors have experienced historic volatility and the traditional 60/40 portfolios, where 60% of your assets are in equities and the other 40% in bonds, did not provide an offset as both asset classes experienced losses simultaneously.

The 2 year and 10 year treasury spread, a traditional recession indicator referenced in my last entry from September, remains negative. The yield curve has since inverted further to now include a negative 3 month and 10 year treasury spread. This means that investors are able to get a higher yield on a short-term bond (3-12 months) than investing in a 10 year, which is not only a logical anomaly but also disrupts the normal lending and borrowing mechanisms of the economy. As companies and individuals seek short term funding for various needs, they will face higher borrowing costs, and thus, may cut back or wait on spending. These decisions include spending on wages and hiring, which makes for a prime recessionary environment.

That is the hope and intention of the historic rate hiking policies from the Federal Reserve, which aim to cool inflation by ushering in economic contraction. With all cycles, investors have recently been on the lookout for signs that this tightening cycle is nearing an end, rather than closer to the beginning. A growing chorus of critics are pointing to another possible misstep by the Fed; that they have tightened too much too fast, as it may take up to 12 months for each Fed rate increase to impact the economy. These critics suggest the Fed should now pause or slow down considerably, to avoid a deep recession, just like it should have slowed the inflationary pandemic support it provided a few years back.

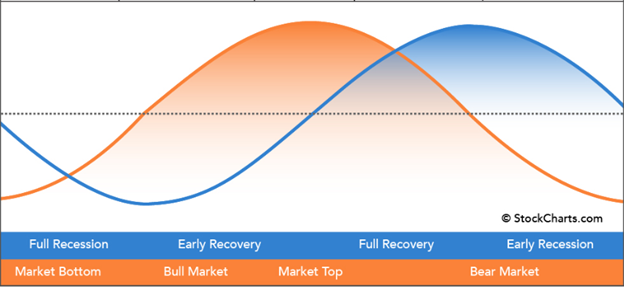

The effects in the overall economy tend to reflect and be discounted in the stock market anywhere from 6 to 12 months in advance. As the chart below illustrates, the expansion and contraction cycles in the economy and the equity markets are not simultaneous, which is why stocks can be bullish and appreciating while the economy is simultaneously in a contraction. This was the case in 2020, when the markets were rallying while the economy came to a standstill during the middle of the pandemic. At that time, investors were pricing in the anticipated economic recovery in 2021, resulting from the re-opening and impacts of the flood of support (fiscal & monetary) that was initiated to stoke inflation in the face of the pandemic’s initial deflationary impact.

Investors may be counterintuitively cheering for the prospects of bad economic data, where bad news is good news, as it should signal the end of the Fed’s tightening cycle and allow better opportunity for growth oriented investments to shine again. However, it stands to reason that the pain will persist for many since higher unemployment appears to be Jerome Powell’s pivot point, at which time the Fed is expected to pause rate hikes and consider supporting economic expansion again.

2022 will go down in the history books as an eventful year for the markets. Both conservative (bond heavy) and aggressive investors (tech, thematic, crypto etc.) experienced extraordinary losses. Cash and commodities were the only two asset classes with positive performance for the year (as of 12/2/22 close)*. When accounting for inflation at around 7%, cash has a negative real return as well, so there have been very few places to hide this year. This is why there is so much hope and anticipation for the New Year and brighter opportunities for investment returns in the years ahead.

As always, we thank you for your continued support and appreciate being able to serve your family’s financial needs. We hope you have a wonderful Holiday Season and a Happy New Year.

~Shar Gogerdchi, CFP®

*CIRStatements Major Indices Performance YTD report 12/2/2022