Interest rate and bond market dynamics have been the focus of several of my posts over the years. I write to you this month to share some additional perspectives on what has happened recently that may lead to a “Stagflation” scenario for the economy.

Stagflation, which is sometimes referred to as recession-inflation, is the combination of slower growth and persistent inflation. Stagflation presents a unique challenge to investors since growth and interest rate sensitive allocations would both be simultaneously under pressure (stocks and bonds).

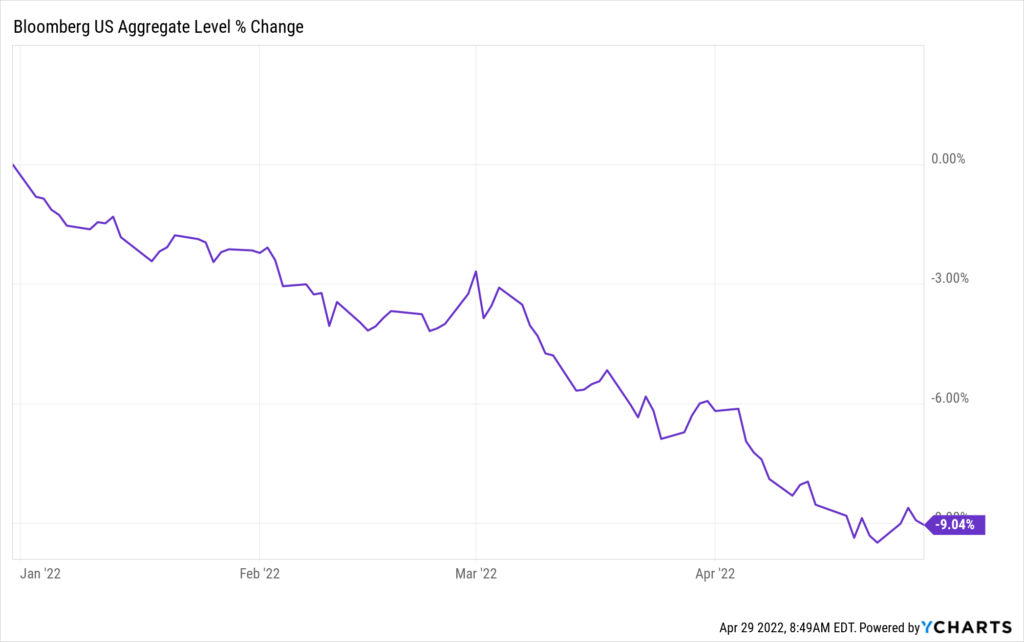

In addition to a stock market sell off this year, the bond market also experienced losses, the extent to which have not been seen since the early 1980s and Civil War era. Stocks and bonds usually move in opposite directions, where bonds (fixed income) values should rise when stock values decline.

We now see the highest inflation in over 30 years and the Federal Reserve has begun raising interest rates. The Fed has also announced a balance sheet runoff with the aim to tighten financial conditions and get control of non-transitory price increases that are much higher than they expected or intended. These monetary policy changes come after a period where the Fed provided unprecedented liquidity and monetary support to the economy during the pandemic, resulting in a 40% increase of US dollars in circulation (as measured by M2 money supply).

These interest rate and monetary tightening expectations have led to historic losses for the bond market. As of the time I write this article, the Bloomberg US Aggregate Bond Index, which broadly tracks the performance of the U.S. investment-grade bond market, has lost over 9% since the beginning of the year (chart below). That equates to a 36% annualized negative rate of return, levels of losses usually reserved for stocks not for the fixed income asset class. The bond market is intended to provide stability and lower volatility for more conservative investors and portfolios, surely leading to many sleepless nights for those portfolio managers with little experience or background with these conditions.

With a negative GDP print for the 1st quarter of 2022, it is easy to see how we could be headed toward an economic contraction and possible recession as soon as this year. During times of economic contraction, the Fed usually ends up providing monetary easing in order to avoid deflation. However, today’s inflation does not seem to be transitory in nature or based on interest rate policy decisions. Instead, inflation today is also caused by COVID-related supply chain issues, aging workforce demographics, the War on Ukraine and geopolitical trade agreement fluctuations. Thus, inflation may persist longer while interest rates continue to increase.

Being aware of these dynamics and sticking to a disciplined investment management process is critical to navigating the economic fluctuations that we are experiencing. The work and efforts of LEWA’s financial planning and investment management process is based on these notions, taking into account various economic factors and return expectations when providing advice.

I hope you found this segment informative and helpful. If you would like more information on this topic or have any questions about your financial situation, please feel free to reach out.

Shar Gogerdchi, CFP®